The Cost of Procrastination: Retirement

When it comes to retirement planning, one of the most common mistakes people make is waiting too long to get started. Retirement may feel far away, but delaying—sometimes even just five years—can have serious consequences for your finances, your lifestyle, and even your peace of mind.

Why Do We Put It Off?

As our advisors Rilee and Duane shared in our conversation, many people see retirement as something “future-me” will figure out. Life is busy, finances can feel overwhelming, and sometimes there’s even fear of facing what the numbers might look like. Add in today’s culture of instant gratification and lifestyle creep—where each raise or bonus leads to a bigger car or nicer vacation—and saving for retirement often slips down the priority list.

But as Duane pointed out, “getting started early really puts the power of time on your side.”

The Financial Cost of Waiting

The biggest consequence of delaying is the lost opportunity for compound growth. Compound interest rewards consistency over time, and the earlier you begin, the less you need to contribute each month to reach the same goal.

For example, Duane shared a simple calculation:

- Saving $100 a month for 25 years at 5% return could grow to about $60,000.

- Stretch that to 30 years, and the same monthly contribution grows to about $84,000.

That extra five years—just 10% of a typical working career—adds a 33% boost to the outcome. Waiting means you’ll need to save more, work longer, or adjust your retirement lifestyle expectations.

“Those who understand compounding tend to have about 20% more in savings than those who neglect it.” 1

And as Rilee reminded us, it’s not just about account balances. Health changes can make it harder or more expensive to qualify for certain protections, and unexpected life events could force early retirement. Planning ahead gives you options.

The Non-Financial Costs

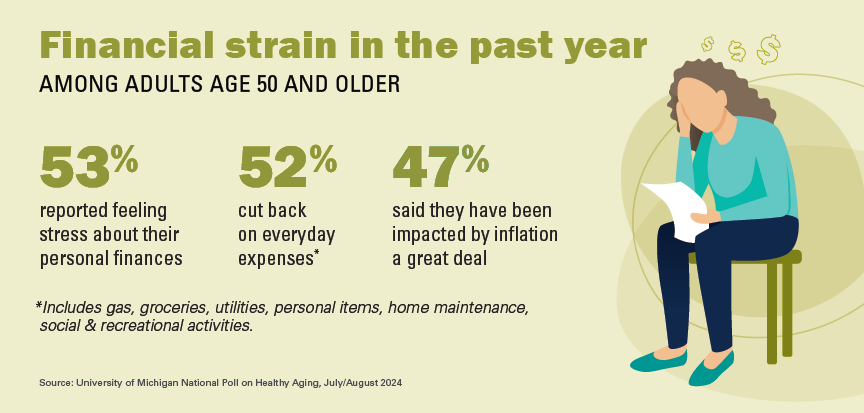

Delaying doesn’t just shrink your nest egg—it can also shrink your sense of security. Without a plan, uncertainty and stress tend to grow. Rilee shared that having a clear plan brings peace of mind, while Duane pointed out that studies show financially secure retirees often live longer, partly because they experience less stress.

Research published in 2023 found clear causal links between financial hardship in older adults and increased risk of depression, worse self-reported health.2

In short: procrastination steals not just dollars, but confidence and health.

“I’ve Waited Too Long—Now What?”

If you’re worried you’ve delayed too long, don’t panic. The first and most important step is simply to start. That could mean:

- Talking with a financial advisor about your specific situation.

- Setting up an emergency fund if you don’t already have one.

- Enrolling in your workplace retirement plan, even at a small percentage.

- Making consistent contributions and building the habit.

As Duane put it, “Every single person who ends up with a million dollars in their retirement account had to start.”

One Small Step Today

Both Duane and Rilee agreed: the single most important step you can take today is to just get started. Even if it’s a small amount—$25 a month—it builds momentum and gives you experience investing. The earlier you begin, the more time you give your money to grow.

And if you need a little motivation? Think of Duane’s Friends reference: “Unagi.” Ross may have used it to mean a state of total awareness, but it fits retirement planning too. Becoming aware of your financial future—and taking action now—is the key to avoiding the cost of procrastination.

Source: tenor.com

Sources

1 Blanton, Kimberly, Our Blind Spots Cut Retirement Savings, April 7, 2016, https://crr.bc.edu/our-blind-spots-cut-retirement-savings/

2Magali Dumontet, Yves Henchoz, Brigitte Santos-Eggimann, Do financial hardships affect health? A study among older adults in Switzerland, European Journal of Public Health, Volume 34, Issue 1, February 2024, Pages 7–13, https://doi.org/10.1093/eurpub/ckad202