The Cost of Procrastination: Estate Planning

When it comes to finances, procrastination has a price tag. In this final installment of our “Cost of Procrastination” series, we’re tackling estate planning—a topic many people avoid because it feels uncomfortable, overwhelming, or simply not urgent.

But here’s the truth: putting off estate planning can create financial, emotional, and even legal challenges for the people you love most.

Why People Delay Estate Planning

Estate planning brings up tough realities—our own mortality, family dynamics, and complicated decisions. For some, it’s fear. For others, it’s cost. And for many, it’s simply a case of “I’ll be gone, so it won’t matter.”

Unfortunately, waiting until a crisis forces the issue means leaving loved ones with stress, uncertainty, and potentially expensive consequences.

What Happens Without a Plan?

When someone passes away without a will or trust, their estate typically goes through probate—a court process that can be costly, time-consuming, and emotionally draining. Family conflicts often arise over sentimental items, financial assets, or even long-standing traditions. Without clear instructions, the courts (not you) decide what happens next.

In addition, lack of planning can lead to unnecessary taxes. For example, in Oregon, estates over $1 million are subject to estate taxes. Without proper planning, a family could end up paying far more in taxes than necessary—reducing what stays in the family and increasing what goes to the state.

Common Excuses for Putting It Off

We hear them all the time:

- “My kids can handle it.”

- “I don’t care, I’ll be gone.”

- “It’s too expensive.”

- “I’ll get to it later.”

But the reality is, waiting often makes things harder and more expensive in the long run. And, like life insurance, many don’t think about estate planning until it’s almost too late—after a serious illness, accident, or loss.

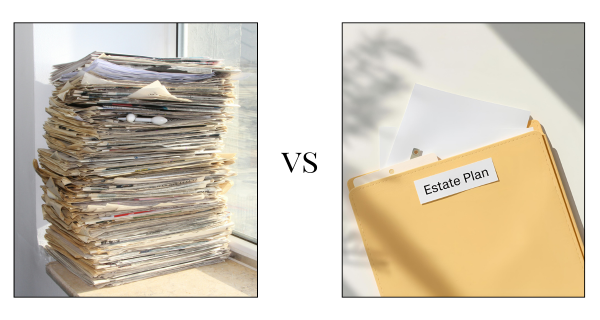

Peace of Mind Through Planning

Estate planning isn’t just about dividing assets. It’s about creating clarity, reducing conflict, and protecting your family’s financial well-being. A plan can:

- Ensure your wishes are honored.

- Minimize unnecessary taxes.

- Reduce stress and conflict for loved ones.

- Provide security through tools like powers of attorney and advance directives.

When everything is laid out clearly, both you and your family gain peace of mind. You’ll know your legacy is protected, and your loved ones won’t be left scrambling in an already difficult time.

Where to Start

A good first step is talking with your financial advisor. They can help evaluate your situation, organize your accounts, and connect you with the right estate attorney for your needs. For simpler estates, they may even recommend cost-effective solutions like beneficiary designations (payable-on-death or transfer-on-death) that can keep certain assets out of probate entirely.

For more complex situations, an estate attorney is essential to draft wills, trusts, and other legal documents tailored to your state’s requirements.

A Note for the DIY Crowd

Yes, there are online templates and low-cost options. While these can be a starting point, it’s important to remember that estate law varies by state. A document valid in one place may not hold up in another. If you choose a DIY route, consider having an estate attorney review your documents to ensure they’re valid and effective.

Don’t Forget the Basics

Estate planning isn’t just about distributing assets. Powers of attorney and advance directives are critical. These documents ensure someone you trust can make financial or medical decisions if you’re incapacitated. Without them, your loved ones may have to navigate the courts—right when quick decisions are most needed.

The good news? Advance directive forms are often available for free through your local hospital or primary care provider’s office. Having these on file can make a huge difference if the unexpected happens.

The Real Cost of Waiting

Procrastination in estate planning doesn’t just cost money—it costs peace of mind. By putting it off, you leave your family vulnerable to legal battles, tax burdens, and emotional conflict. By taking action now, you protect not just your wealth, but your loved ones’ well-being.